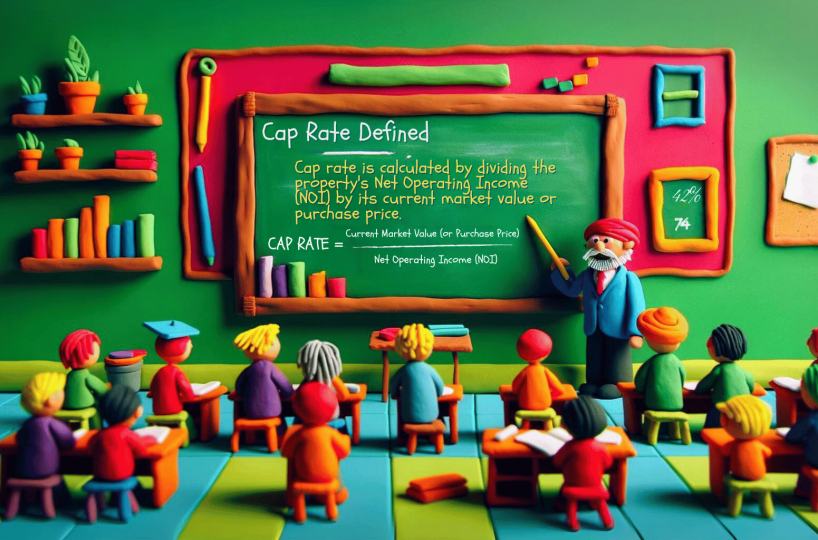

Establishing Cap Rate

Cap Rate is established by dividing the Net Operating Income (NOI) of a property by the value of that property. The cap rate essentially shows the relationship between the property value and the potential income that a particular property could produce. The higher the cap rate the more attractive the property is.

Net Operating Income NOI

Let’s look at the Net Operating Income half of the cap rate equation. NOI consists of all revenue from the property, minus any reasonable operating expenses. NOI is a pre-tax figure, appearing on a property’s income and cash flow statement, that excludes principal and interest payments on loans, any capital expenditures, depreciation, and amortization. In order to establish Net Operating Income, you total the annual rents collected for a property, this is the Gross Income. Once this figure is established you would subtract the following expenses.- Annual Property taxes

- Any Insurance

- Maintenance

- Repairs

- Vacancy rate

- Property management fees