In 2021, Colorado prohibited source-of-income discrimination to help voucher holders access rental housing. However, fair housing advocates documented that many landlords found ways to circumvent these protections—delaying paperwork, refusing to cooperate with housing authorities, or taking advantage of exemptions for small landlords.

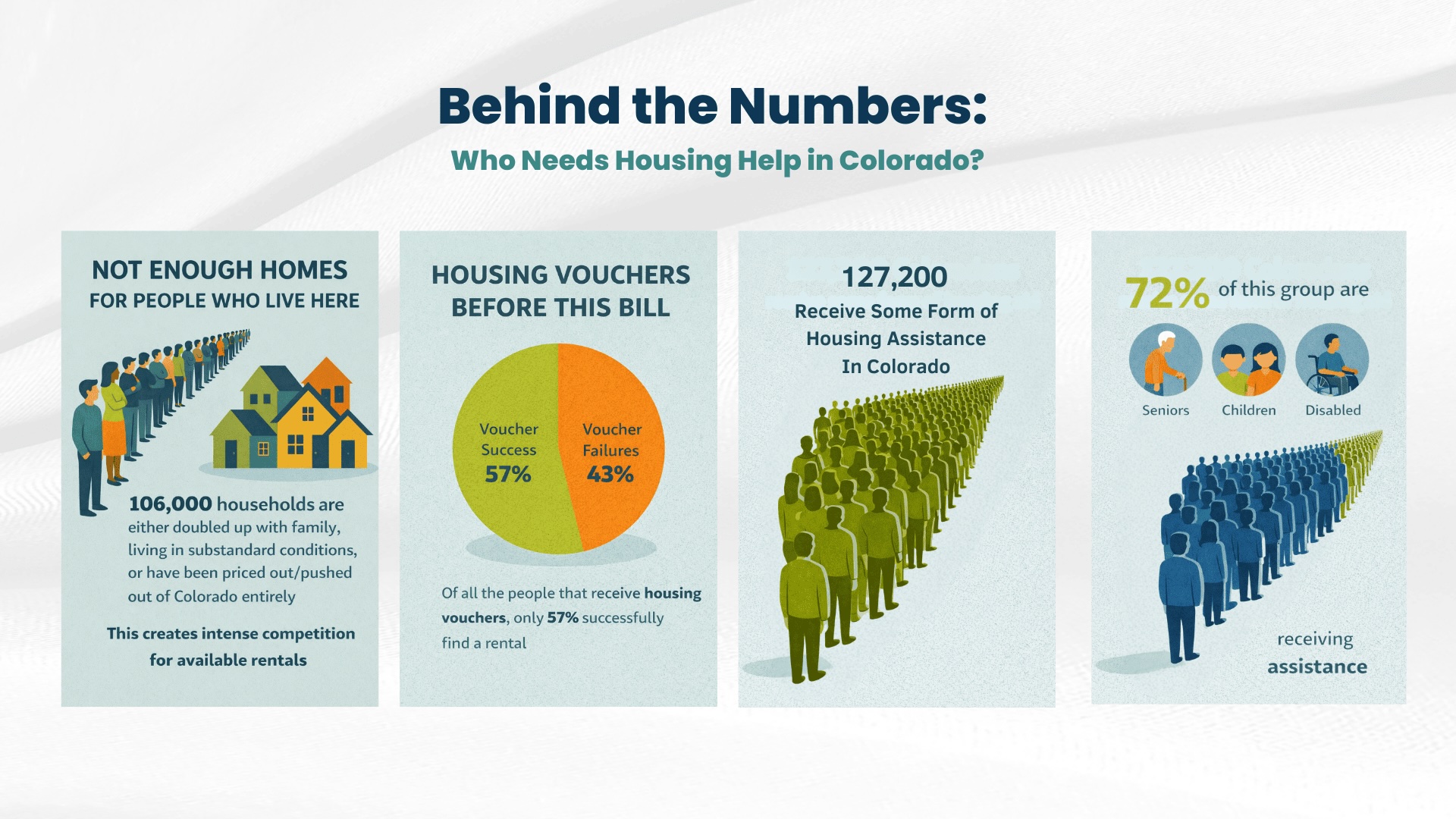

The result was stark: only 57% of voucher recipients nationally could successfully use their assistance to secure housing, and Colorado's 127,200 voucher holders—72% of whom are seniors, children, or people with disabilities—faced a housing market where legal protections existed on paper but often failed in practice.

HB25-1240, signed into law on May 29, 2025, closes these loopholes by eliminating the small landlord exemption, requiring active cooperation with rental assistance applications, and establishing enhanced notice requirements and penalties for violations.

The Three Core Changes

- Mandatory Cooperation: Landlords must actively respond to rental assistance documentation requests—passive non-cooperation is now explicitly illegal

- Enhanced Eviction Notices: Properties with federal mortgage backing or program participation must provide 30-day notice before filing nonpayment evictions.

- Significant Financial Penalties: Mandatory minimum damages of $5,000 per violation, with escalating consequences for repeat offenders reaching $50,000.

Who Must Comply

All Colorado landlords—no exemptions based on portfolio size. Whether you own one rental unit or manage hundreds, these requirements apply.

"Landlord" includes:

- Traditional residential landlords (§38-12-502(5))

- Mobile home park management (§38-12-201.5(3))

"Housing Subsidy" means (§38-12-902(1.7)): Any rent payment from public or private assistance programs, including Section 8, HUD-VASH, state vouchers, emergency rental assistance, and private nonprofit programs.

Effective Date: August 6, 2025 (applies to conduct on or after this date)

Mandatory Cooperation Requirements (§24-34-502(1)(r))

What's Required?

It is now unlawful for landlords to fail to:

- Make reasonable efforts to timely respond to requests for information and documentation necessary for rental assistance applications, OR

- Cooperate in good faith with tenants applying for rental assistance, including by refusing to provide required documents

Violation of either provision = unlawful discrimination

Response Timeframes (Best Practices):

| Request Type | Response Time |

|---|---|

| Initial acknowledgment | 1-2 business days |

| Simple documents | 3-5 business days |

| Complex requests | 5-10 business days |

| Third-party coordination | 10-15 business days |

Commonly Requested Documents

- Lease Information: Current lease, renewal terms, rent amount, security deposit, utilities

- Rental History: Payment history, lease compliance, violations, eviction history

- Property Details: Address, unit description, bedrooms/bathrooms, square footage, amenities

- Owner Information: Contact details, management company, tax ID, W-9

- Inspection Documents: Scheduling access, previous results, corrections, certificates

- Financial Data: Rent comparables, utility allowances, fee structures

What You're NOT Required To Do

- Accept unqualified tenants (standard screening still applies)

- Waive legitimate business requirements

- Provide instant responses (timely, not instantaneous)

- Provide documents you don't possess

- Accept below-market rates outside program parameters

What You CAN Still Do

- Apply consistent screening criteria to all applicants

- Verify income, rental history, references, and background

- Deny applications for legitimate, non-discriminatory reasons

- Enforce lease terms equally for all tenants

- Charge reasonable document reproduction fees

Important: For voucher holders, you CANNOT inquire about or consider:

- Total income amount (except to verify it doesn't exceed 200% of rent)

- Credit score/history (unless required by federal law)

- Voucher amount in income calculations

Compliance Essentials

DO:

- Designate a point person for assistance requests

- Acknowledge all requests within 1-2 days

- Use response templates and tracking systems

- Document everything: dates, actions, communications

- Treat all requests professionally and consistently

DON'T:

- Ignore requests or delay until voucher expires

- Say "We don't work with Section 8"

- Impose conditions not applied to other applicants

- Refuse to communicate with housing authorities

- Make statements suggesting voucher preference/opposition

Enhanced Eviction Notice Requirements (§38-12-1502)

Covered Dwellings

The 30-day notice requirement applies only to properties that are "covered dwellings":

Properties with:

- Federally-backed mortgages (FHA, VA, USDA, Fannie Mae, Freddie Mac)

- Participation in a federal housing program as the property/landlord (Section 8, public housing, HUD programs)

Properties NOT covered:

- Conventional mortgages from private lenders

- Owner-financed or owned free-and-clear properties

The Requirement

For covered dwellings: 30 days' total notice before filing eviction for nonpayment

Timeline Example:

- Day 1: Serve standard 10-day Colorado demand

- Day 11: Demand period expires

- Days 11-30: Additional waiting period

- Day 31+: May file eviction

Action Items:

- Determine covered dwelling status for each property

- Document mortgage backing or federal program participation

- Adjust eviction procedures for covered properties

- When uncertain, follow the 30-day requirement (safer)

Warranty of Habitability Change (§38-12-507)

The Amendment

Rent reimbursements for warranty of habitability breaches must be calculated on total rent paid to landlord, including both tenant-paid and subsidy-paid portions.

Example:

- Total rent: $1,500/month ($450 tenant + $1,050 subsidy)

- Fair value during breach: $1,000/month

- Breach duration: 3 months

- Monthly reimbursement owed: $500 ($1,500 - $1,000)

- Total reimbursement: $1,500 ($500/month × 3 months)

Key Point: The tenant receives $1,500 total—not just $150 (which would be the difference if calculated only on their $450 portion). This ensures subsidized tenants receive the same habitability protections as market-rate tenants.

Financial Penalties

Mandatory Minimum: $5,000 Per Violation in Civil Court Actions

When tenants file civil lawsuits in district court under §24-34-506, courts must award at least $5,000 if they prove:

- Discrimination based on housing subsidy use, OR

- Violation of cooperation requirements (§24-34-502(1)(r))

Plus Additional Damages:

- Actual damages (including voucher forfeiture losses)

- Punitive damages

- Attorney fees and costs

- Injunctive relief

Escalating Commission Penalties

For repeat offenders within specific timeframes:

- First violation: Up to $10,000

- Second (within 5 years): Up to $25,000

- Third+ (within 7 years): Up to $50,000

Maximum Exposure Example:

- Third violation: $50,000 civil penalty

- Plus $5,000 minimum to plaintiff

- Plus actual damages: $30,000

- Plus attorney fees: $15,000

- Total: $100,000+

Frequently Asked Questions

Q: Must I accept all voucher applicants?

No. Standard screening criteria still apply. You may deny for legitimate reasons like poor rental history or insufficient income.

Q: What if the voucher doesn't cover my full rent?

You can charge market rate. Verify the tenant can afford their portion. You cannot refuse solely because a subsidy is involved.

Q: Do all properties need 30-day eviction notice?

No. Only "covered dwellings" with federal mortgage backing or program participation.

Q: How do I determine covered dwelling status?

Check mortgage documents for federal backing (FHA, VA, USDA, Fannie Mae, Freddie Mac) and verify federal program participation.

Q: What's "good faith" cooperation?

Responding promptly and professionally, providing accurate information, working constructively with housing authorities, maintaining consistent communication.

Q: Can I charge security deposits to voucher holders?

Yes, on the same terms as other tenants, within legal limits.